AluReport 1/ 2024

- Investing in excellence: New coil coating line consolidates AMAG’s position as a surface-critical product specialist

- Knowledge-based quality leadership: Interview with CEO/COO Dr. Helmut Kaufmann

- From ingot to icon: Aluminium architectural products

- Bright aluminium products: Interview with Tommaso Fiorentini, Vice President of Almecco

- A vision of radiance: Aluminium as the key to perfect daylight control

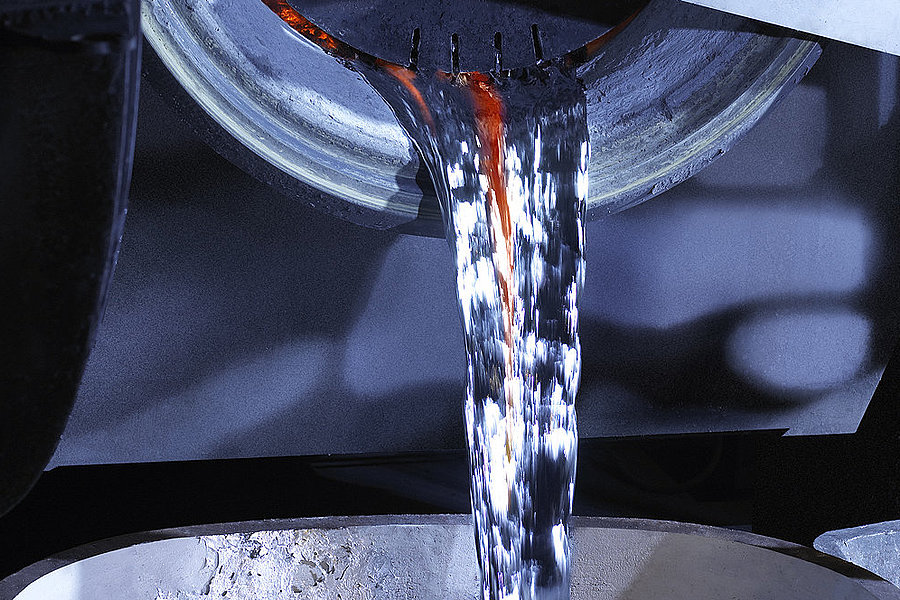

- Hot rolling emulsion: A material with a massive impact

- The art of adhesion: The influence of surface texturing and surface chemistry on adhesive bonding performance

- Joining in automobile construction part 1: Dry-film lubricants as an impact of automotive adhesive joints

- Joining in automobile construction part 2: The decisive role of surface treatment for first-class spot welding results in automotive production